Space technology IP trends: cosmonautic patent applications take off

Over the past few years, global space activity has grown massively. Between 2000 and 2013 an average of 110 spacecraft were launched per year. However, between the period 2017 to 2019 that figure grew more than four-fold to 470 spacecraft, and with SpaceX launching its Starlink mega-constellation and Blue Origin planning to launch its own mega-constellation soon, this rate of launch will only increase further.

With this increase in global space activity has come an increase in investment. Public investment still represents the bulk of funding in space activity. However, the past few years has seen private funding growing tremendously with 5.7 billion US dollars invested in 2019 fuelled by opportunities for innovation in this field. This funding seems well placed as The Space Report indicated that commercial revenue in the space sector exceeded 330 billion US dollars in 2019.

In order to protect this funding, many public institutions and companies from around the world have invested in patent protection. Last year, the European Space Agency, the European Patent Office and the European Space Policy Institute issued the results of a study to identify trends in the space sector. The salient points of this study are discussed in this article. Graphs and illustrations published in this article are used with kind permission of the European Patent Office.

Filing numbers

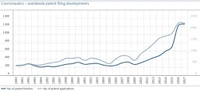

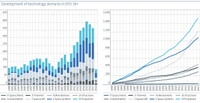

Over the past ten years, the number of astronautical patent applications filed worldwide has more than doubled. This trend is replicated in filings at EPO38+ (which is the territory of the EPO’s 38 contracting states and extension states). These trends are shown below. The increase in patent applications mirrors the increase in investment shown over the past few years. Moreover, this replication of the filing trend in Europe indicates that the EPO38+ are seen globally as a relevant and mature market.

Country statistics

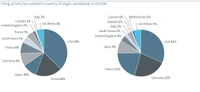

The report then analysed the filing activity by inventor’s country of origin. This provides a snapshot of a particular countries’ activity. This is shown as a pie-chart in the figure below with the left pie-chart showing the worldwide filings and the right pie-chart showing the EPO38+ filings.

From these pie-charts, it is clear that innovation developed by US-based inventors have produced most of the cosmonautical patent applications both worldwide and in the EPO38+. This is not surprising given that the US has the highest annual public spend in the space sector and the fact that the US has a thriving private space industry.

One interesting observation is the lack of Chinese-based innovation being protected in the EPO38+. By comparing the two pie-charts, it is evident that Chinese-based innovation accounts for 19% of global patent filings, but does not appear at all on the EPO38+ filing analysis. This is very different to other technological areas where Chinese entities have a very high patent filing rate.

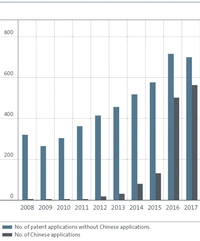

Under closer scrutiny, the number of cosmonautics patent applications filed in and only in China has increased dramatically over the past ten years. In particular, in 2018 more than 50% of patent families were filed only in China, whereas only approximately 5% of patent families originating in China are also protected in other jurisdictions. This trend is best visualised below, where the rapid growth in patent filings in China is shown. This relatively high level of domestic protection for Chinese space technology may make it difficult for non-Chinese companies to penetrate the Chinese domestic market.

Technology breakdown

Generally, the technology used to control and operate a spacecraft during its mission in a space environment can be broken down into eight different categories. These categories are:

- Propulsion

- Structures

- Space System Control

- Mechanisms

- Spacecraft Electrical Power

- Thermal

- Automation, Telepresence and Robotics

- Space Debris

The breakdown of the number of patent applications in each of these categories is shown below.

As is evident from these graphs, each of these technical categories have all shown an increase in activity over the past few years. In particular, the number of applications worldwide in 2016 in each category is roughly four-times as high as in 2006, whereas in the EPO38+ the surge is less marked with a two to three times increase over the same period. This indicates that the overall increase in patent activity is spread amongst various areas of technology which shows that innovation is occurring across all areas of the sector.

The largest amount of activity both worldwide and EPO38+ is in propulsion technology and space systems and has been so for many years. However, recently, space debris related technologies have emerged and grown. This follows the increased discussion around spaceflight safety and sustainability given the proliferation of small cubesats and mega-constellations and the real potential impact of the Kessler syndrome.

Owner analysis

A review of owner analysis shows that a mixed collection of large international companies, government institutions and academic players are defined as large players.

The following tables show the large players for worldwide filings and for EPO38+ filings.

As can be seen from this analysis, many of the large players are companies who have established businesses in the space sector and these account for the vast majority of the patent filings. However, there are several large companies in these lists that have their core business outside of the space sector, but which are innovating in the space sector. Conversely, some large players have ceased filing patent applications for innovation in the space sector. This may mean that this market is no longer of interest to them. Finally, one interesting observation is that the Chinese State owned CASC is the main contractor for the Chinese space programme and this is by far the largest Chinese player for patent filings.

In addition to the large player analysis, a study of smaller players was carried out. A smaller player is defined as having less than 500 patent families at the time of the study. It is useful to look at these players as this shows patent activity (and so innovation) in special business areas or specialised technological development.

As will be evident the majority of these smaller players are companies. Some of these companies have a very narrow technological focus which indicates a high degree of specialism in a particular area. For example, Astroscale develops deorbiting technologies to address the problem of space debris, WorldVu satellites (now known as OneWeb) is a LEO mega-constellation satellite company specialising in internet provision (similar to Starlink) and Shanghai Engineering Center for Microsatellites (now known as Innovation Academy for Microsatellites of the Chinese Acadamy of Sciences) has worked on microsatellite research and has been involved with the new generation of BeiDou navigation satellites.

Conclusion

Over the past few years, there has been a steep growth in patent filings both globally and in the EPO38+. This has been driven by innovation in mature areas of technology (such as propulsion and space systems) as well as an increase in newer, less mature areas such as space debris. The vast majority of Cosmonautics patents are company owned which indicates that the market is mature as patents owned by academic institutions are indicative of a less mature market.

There is a dynamism to the sector with players entering and leaving the sector. Many of these new players have a very specific focus for their technology.

Another interesting feature is that a significant share of the patents applied for in EPO38+ are owned by non-European companies which indicates that Europe is an interesting market for non-European companies.

Finally, there has been a recent rapid development of many areas of cosmonautics that have not made the list. For example, SpaceX has developed its Raptor engines and its Starlink satellite mega-constellation and other players such as Warpspace is developing its inter-satellite communication technology. This may be because this study has reviewed published patent documents. Therefore, an 18-month delay exists between the patent application being filed and its inclusion in this report. Accordingly, it would be interesting to see the patent landscape when this analysis is carried out again. Watch this space….

Cosmonautics – The Development of Space-Related Technologies in Terms of Patent Activity

View the European Patent Office and the European Space Policy Institute report.

Read more (pdf)Graphs and illustrations published in this article are used with kind permission of the European Patent Office.