Is the appetite for green technology waning? Insights from worldwide patent office statistics

On 18 April 2025 the United States Patent and Trademark Office (USPTO) formally terminated its Climate Change Mitigation Pilot program, with the Trump administration also cancelling billions of dollars of funding into green projects. Does this mark a turning point in the global landscape or is the USA an outlier?

USA picture

In June 2022, the Climate Change Mitigation Pilot program was launched by the USPTO. The program sought to accelerate the examination of patent applications for innovations that mitigate climate change and would last one year or until 1,000 grantable petitions had been received. A year later, having only received 354 petitions, the program was expanded to include innovations in any economic sector designed to make progress toward achieving net zero. The deadline was extended until 2027, or until 4,000 grantable petitions had been received. At the time of its suspension in January this year, however, only 1,399 petitions had been filed and 898 of them granted.

The initial program was very limited in scope, since the applications had to contain one or more claims to a product or process that mitigates climate change by reducing greenhouse gas emissions. Whilst the requirements were relaxed when the program was extended in 2023, the scope was still narrow with many applicants finding it difficult to file applications which met the requirements, so the low number of petitions is not necessarily indicative of a lack of green innovation in the USA.

President Trump has, however, reportedly cancelled nearly $8 billion in funding for climate-related projects as part of his administration’s 2026 budget to eliminate funding for the “Green New Scam”, such as direct air capture hubs that were awarded during the Biden administration. Green innovators in the USA will therefore face additional challenges during the Trump administration.

UK picture

In the UK, the Intellectual Property Office (UKIPO) introduced the Green Channel in 2009 to allow applicants to requested accelerated processing of their application if the invention has an environmental benefit. Applicants need only make a reasonable assertion the invention has some environmental benefit.

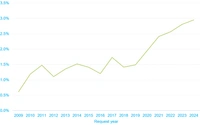

The UKIPO publish the number of Green Channel requests with its annual statistics. Figure 1 (below) shows the percentage of patent applications at the UKIPO that have requested use of the Green Channel each year since its inception. There is an upward trend in the percentage of Green Channel requests, with a noticeable increase since 2019. Although one fewer request was received in 2024 compared to the record number in 2023, overall applications at the UKIPO fell by 5% in 2024 compared to 2023, so the percentage of Green Channel requests still increased.

Global picture

Other countries, such as Japan, China, Canada and Australia also have schemes similar to the UKIPO Green Channel but unlike the UKIPO they do not publish detailed statistics. The number of Green Channel requests is not a foolproof indicator of “green” filings as the criteria is very broad and applications with only a loose link to an environmental benefit can be accepted. A more generally accepted approach is to look at “green patents”, which are typically considered to be patents with a Y02 Cooperative Patent Classification (CPC) classification (technologies or applications for mitigation or adaptation against climate change).

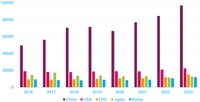

Much of the literature on green innovation uses data up until 2020, so does not give a complete picture of the impact of the Covid pandemic and the years following. Equally, patent applications typically publish at least 18 months after their filing date, so there is a lag in the data when considering patent publications. Last year the China National Intellectual Property Administration (CNIPA) produced a report looking at trends in green patents from 2016 to 2023. In this period, nearly 1.28 million green patents were published worldwide with 45% from Chinese applicants. The overall annual growth rate of 4.8% was largely due to 10% growth from Chinese applicants.

Whilst this shows there is a high level of green innovation in China, most of these patent applications were national rights only filed in China. Between 2016 and 2023 there were 573,000 green patents publications in China but only 18,000 green PCT publications from Chinese applicants compared to 27,000 from Japanese applicants and 17,000 from US applicants. The number of green PCT publications from Chinese applicants is, however, growing over twice as quickly as domestic filings, suggesting a change in strategy from Chinese applicants and a more global outlook. There was also growth in green PCT publications from Korean, Japanese and UK applicants, whereas there was a reduction from US applicants over this period.

European picture

Green patent publications at the European Patent Office (EPO) grow by an average of 9% between 2016 and 2023, resulting in the EPO overtaking the Japan Patent Office in 2022. The EPO also saw year-on-year growth over the whole period, whereas the other IP5 offices each saw a downturn at some point during the period.

A joint study from the EPO and the European Investment Bank (EIB) published in 2024 found, between 2017 and 2021, 26.6% of all green PCT publications were from applicants from EPO member states, followed by Japanese (21.1%) and US (20.2%) applicants. Although 15.6% were from Chinese applicants, there was a 70% increase in green PCT publications from Chinese applicants compared to 16% from applicants from EPO member states over the same period.

Whilst USA applicants remain the largest filers of green patent applications at the EPO followed by German applicants, both have seen a reduction in filings over the last ten years. There are, however, regional pockets of strong green innovation, such as the Nordics. Data from the Danish Patent and Trademark Office (DKPTO) in 2023 showed Denmark, Sweden and Finland had 90, 37 and 33 green patent publications per million inhabitants at the EPO in 2021, compared to less than 10 for both the USA and China. Denmark in particular has a clear strength in wind energy (CPC classification Y02E), with 60% of all Danish green patent applications coming from this field.

Future of green innovation and patents

The data we have discussed in this article shows despite the downturn in green patent publications from USA, Japanese and German applicants, globally the outlook is more buoyant. Equally, despite the reductions in funding in the USA, global funding for green innovation is increasing. In 2023 the EU increased the value of its Innovation Fund by nearly 18% to be potentially worth 40 billion Euros. Last year, the Chinese Government launched eight green bond funds valued at $7.9 billion whilst the Danish Government launched a EUR 670 million “Green Fund” to advance green initiatives by 2030. In the UK, the Net Zero Innovation Portfolio has committed £1.3billion over 4 years.

An International Finance Corporation (IFC) report in July 2025 showed there is a significant link between climate laws and green innovation; countries that pass more climate laws tend to produce more green patents. This link was also demonstrated in an International Monetary Fund (IMF) working paper published in June 2025. This working paper also showed an acceleration in green patent filings boosts real economic activity (GDP), with a peak occurring after three years, compared to a peak of similar magnitude within five years for non-green patents. Green innovation therefore not only positively affects economic growth, but its impact is at least the same as for non-green innovation.

A Danish Patent and Trademark Office (DKPTO) study published in 2024 showed, in the period from 2011 to 2020, just over half the Danish companies filing green patent applications were micro entities and 32% SMEs, but these companies only accounted for around 10% of Danish green patent applications. A similar picture across all EPO member states was shown in the EPO-EIB study, demonstrating larger companies have more comprehensive patent portfolios. In Europe at least, green innovation is being driven by micro entities and SMEs, but they may not be fully realising the value of their innovations or maximising they intellectual property assets. The EPO-EIB study also highlighted smaller companies are more reliant on commercial partners to commercialise their technology and emphasised the value of patents to facilitate access to financing. More can therefore be done to help smaller companies realise the value of their green IP and access funding to allow them to build on their innovative activities and positively impact the global green movement.

Useful links and references

- USPTO, Climate Change Mitigation Pilot Program CLOSED

- Reuters Trump administration scraps $8 billion for climate-related projects

- UKIPO, official statistics, facts and figures for patents, trade marks, designs and hearings, 2024

- CNIPO, information and resources, report on statistical analysis of green and low-carbon patents (2024)

- EPO, new EPO-EIB study, EU single market is a key catalyst for scaling clean and sustainable inventions

- Green Power Denmark

- IFC, Innovation in Green Technologies report, 15 July 2025

- IMF, The Drivers and Macroeconomic Impacts of Low-Carbon Innovation – a Cross-Country Exploration

- WIPO, Patents in the green transition - trends in the global development of future technologies