The UK Patent Box: a potentially different approach to patenting

A primary reason for obtaining patent protection for a particular innovation is to prevent and/or deter unwanted third parties from copying it. At least as far as the UK is concerned however, the obtaining of such patent protection can also serve a very different commercial application, in the form of the UK Patent Box Scheme. At a very high level, the UK Patent Box scheme is an initiative which enables companies to apply a lower rate of corporation tax to profits earned from patented inventions. At its full benefit, the Patent Box allows for a proportion of such profits to be levied at a corporation tax rate of 10%, rather than the full 25%, which might otherwise be levied. Further information on the Patent Box can be found, at a general level, in our earlier article “Here comes the money…making sure to monetise your patenting and research efforts”.

Related article

Here comes the money…making sure to monetise your patenting and research efforts, 17 February 2020.

Read moreSo, to the extent a UK based entity has spent a lot of time and effort developing an innovation that is potentially worthy of a UK patent, even if this entity has no intention of protecting this innovation against third party copying, there might nonetheless be longer-term cost savings to be realised, from a corporation tax perspective, from navigating the UK patent process to protect this innovation.

In respect of any tax relief which might be possible under the Patent Box scheme, the quantum of this relief must, of course, be tempered against the expected cost of securing the requisite patent protection to obtain this relief. Thus, where the primary reason for obtaining a UK patent is to facilitate usage of the UK Patent Box scheme, the construction and pursuit of the underlying UK patent application may require a slightly more nuanced approach when compared to other approaches which might otherwise be adopted in instances where the intended application of the patent is less Patent Box orientated.

Speed of protection

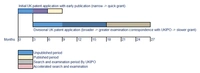

From a Patent Box perspective, getting a UK patent granted quickly is an important consideration, noting that any tax relief under the Patent Box Scheme can only be initiated once the UK patent application is granted. Therefore, any techniques which can help reduce the period in which the UK patent application is pending can be extremely helpful.

Such techniques might include a request for the UK patent application to be given accelerated search and examination status, along with a related request that the UK patent application be published early. With these techniques, it is possible to obtain a granted UK patent in as little as nine months from the date when the UK patent application is first submitted. This is a somewhat truncated timeframe, in comparison to some of the more traditional approaches used to obtain UK patent protection where obtaining a granted UK patent in any timeframe less than 21 months would be considered unusual.

Scope of protection

The Patent Box scheme is fundamentally quantitatively defined, in so far as it notionally only requires the existence of a patent covering a profit-making innovation to make use of the scheme. Qualitative considerations, such as in terms of how broadly the innovation is covered by the patent, are therefore less of a concern, which is certainly not a viewpoint adopted in instances where the primary intent for the patent is to prevent third parties from copying/replicating this innovation.

So, where a primary purpose for a UK patent application is the Patent Box scheme, it may be more appropriate to limit the scope of protection from the outset. Doing so may then reduce the likelihood of the UK Intellectual Property Office (UKIPO), which is the entity that will assess whether the UK patent application is worthy to be granted, objecting to the scope of the patent application being too broad, and hence not allowable. Avoiding such objections will thus speed up the process for securing granted UK patent status, and will avoid related additional costs in having to respond to these objections, which will be costs that detract from any tax relief that might subsequently be obtained from the Patent Box scheme.

Seeking more limited/focussed protection under the UK patent will also make the resultant UK patent more resistant to revocation later on. From a taxation perspective this may be helpful, noting that if revocation of the UK patent was to happen it may raise questions as to whether any tax relief which might have been obtained under the Patent Box scheme, as a result of this (revoked) UK patent, would then need to be repaid.

In instances where the patent protection being sought is in respect of a component part of a wider product to which profits are otherwise attributable any tax relief sought under the Patent Box scheme can become more difficult to calculate in these situations, defined as “mixed source of income” situations. In these instances, from a Patent Box perspective, including one or more fall-back positions in the patent specification (in the form of so-called “dependent claims”), which expressly define the scope of patent protection as also encompassing any wider product(s) in which the component part is intended to be employed, may be helpful for better arguing that the profits of the wider product should qualify for relief under the Patent Box scheme.

Cost of protection

While reference has been made to the obtaining of a UK patent in a number of instances above, for completeness, usage of the UK Patent Box Scheme does not necessarily require a UK patent. A patent obtained from a number of other patent offices across Europe, such as the European Patent Office (EPO); or those from Germany; Denmark; and other European territories, may also be used to secure relief under the UK Patent Box Scheme.

That being said, UK based entities seeking to use the UK Patent Box Scheme may find it most effective, and cheapest, to obtain the requisite patent protection by way of a UK patent, noting the official fees for obtaining a UK patent can be as little as £310, at the time of writing. This compares, for example, with a European patent obtained from the EPO where the official fees will be in excess of £4,400, at the time of writing.

Official fees aside, and as alluded to previously, a “Patent Box” approach to obtaining a UK patent must be mindful of the costs involved in its initial preparation stage, and subsequent application/examination stage, to avoid these costs exceeding any tax relief that might be expected from any claim under the Patent Box scheme, once the UK patent application is granted.

Patent box and divisionals

For any UK patent application that is pursued with Patent Box considerations in mind, as long as the underlying invention is recited in broader terms somewhere in this application as originally submitted, there is still the possibility of obtaining broader patent protection via a divisional UK patent application, if required:

With this divisional approach the best of both worlds is then possible, in terms of having a narrower, more quickly obtained, first UK patent that is suited for Patent Box, along with then a second, broader yet slower obtained, divisional UK patent that better serves as a deterrent/enforcement tool against third parties.

Summary

Any intention to use the Patent Box scheme provided by the UK Government must be approached with a sense of pragmatism. The scheme is rightly there to financially reward UK based entities that have taken the time and effort to devise innovation worthy of patent protection. However, care must be taken to ensure that any costs required to obtain this protection are proportionate to the anticipated relief that might subsequently be obtained under the scheme over the lifetime of the patent.

Useful links

- “Here comes the money…making sure to monetise your patenting and research efforts”: dycip.com/monetise-patenting-efforts

- “Guidance: get your patent granted more quickly”, UKIPO: dycip.com/patentsfastgrant

- HMRC internal manual: “Corporate Intangibles Research and Development Manual”: dycip.com/corporateintangibles

- Guidance: “Use the Patent Box to reduce your Corporation Tax on profits”, UK Government: dycip.com/corporationtaxpatentbox